Name

The name of the organization shall be “The Insurance Companies’ Chief Anti-Money Laundering Compliance Officers Association in Bangladesh (ICCAB)” or simply “Insurance Companies' CAMLCO’s Association in Bangladesh (ICCAB)”.

Objectives

ICCAB was formed in the insurance industry to establish global best practices on AML/CFT, and all Chief Anti-Money Laundering Compliance Officers (CAMLCOs) from Life and Non-Life Insurance companies licensed under the Insurance Development Regulatory Authority (IDRA) are part of it. An executive committee shall be formed to oversee the activities and overall vision of ICCAB, as outlined in this charter. ICCAB Executive Committee (ICCAB EC) covers the following core objectives, but is not limited to:

- To promote best practices and professional standards in AML/CFT compliance within the insurance sector.

- To facilitate knowledge-sharing and collaboration among AML/CFT compliance officers.

- To represent the collective interests of members to regulatory authorities (IDRA and BFIU) and other stakeholders.

- To provide training, resources, and professional development opportunities for members. Organizing CAMLCO

conference / BAMLCO conference and other initiatives within the industry to promote compliance culture. - To foster cooperation and dialogue between insurance companies, regulators, and related industry participants on AML issues.

- ICCAB, IDRA, and BFIU work towards a common goal of improving industry trust and reputation and building a strong AML / CFT compliance culture.

Appointment of Members

The Chairman of ICCAB in Bangladesh chairs the ICCAB Executive Committee and is supported by the General Secretary of ICCAB for the overall execution of the vision and responsibility under this charter. The Chairman and the General Secretary are supported by two Vice Chairmen from Life and two Vice Chairmen from Non-Life Insurance companies, and two Joint Secretaries from Life and two Joint Secretaries from Non-Life Insurance companies. The Treasurer, Office Secretary, and Executive Committee Members. The initial Executive Committee of 22 members was formed in a collaborative discussion between the Bangladesh Financial Intelligence Unit (BFIU) and Insurance Industry CAMLCOs for

the first two years.

ICCAB Membership and ICCAB Executive Committee Membership

Membership is open to Chief Anti Money Laundering Compliance Officers (CAMLCOs) of licensed insurance companies in Bangladesh. All CAMLCOs are members of ICCAB.

Executive Committee membership is either selected by the regulator (BFIU) or there may be voting among ICCAB members.

Only a CAMLCO from a Life/Non-life insurance company can be a part of ICCAB.

Available roles:

- Chairman

- General Secretary

- Vice Chairman (2 from Life and 2 from Non-Life)

- Joint Secretary (2 from Life and 2 from Non-Life)

- Treasurer (1)

- Office Secretary (1)

- Members (10)

In all, there should be 22 members in the Executive Committee (EC) based on the roles as mentioned earlier. For the best interest of Life and Non-Life Insurance, there should be 11 members from Life and 11 members from Non-Life. There could be a vacant position.

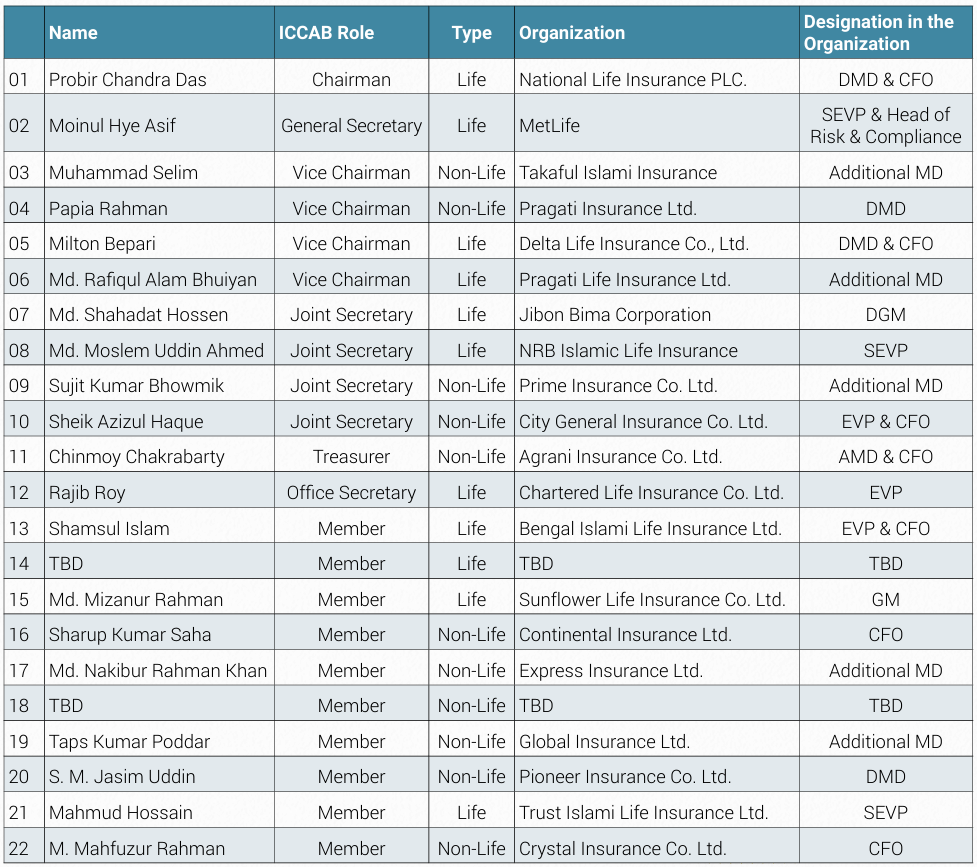

Members (ICCAB) Executive Committee

The ICCAB Executive Committee consists of the following:

A few positions are currently vacant (marked as TBD) due to the departure of some members from the company and the CAMLCO role. The ICCAB EC Committee will fill these positions conveniently at a later date.

Member Voting

A quorum at any Executive Committee meeting is a minimum of six Voting Members’ participation to call the meeting to order. Participation can be in person, via audio, video, or email exchange.

If a voting member is unable to attend the meeting, the member can select an alternate to participate with an agreement from the Chairperson. Usually, this can be Deputy CAMLCO (Proxy).

Each Voting Member has one vote. An affirmative vote requires a majority of participating Voting Members. The Voting Members are allowed to delegate their vote in advance to either their attending alternate (Deputy CAMLCO) or to another EC Member. The majority of votes cannot be cast by proxy.

Voting conducted by email must be unanimous to be considered approved.

Governance

a) The Association shall be governed by an Executive Committee, elected by the members for a two-year term, or members may be selected by the Bangladesh Financial Intelligence Unit (BFIU) based on collaborative discussion with industry CAMLCOs.

b) The Executive Committee’s available roles are enumerated in the earlier section.

c) The Executive Committee shall oversee strategic direction, initiate activities, and manage the affairs of the Association.

d) Regular quarterly meetings will be organized to discuss ongoing AML challenges, regulatory updates, and member initiatives.

e) Special meetings may be convened by the Executive Committee as necessary.

f) Members may deploy additional members from respective committees to support major initiatives such as the CAMLCO / BAMLCO conference.

g) Any unresolved or complex matter may be escalated to IDRA (Insurance Development Regulatory Authority) or BFIU (Bangladesh Financial Intelligence Unit) for support and guidance based on the alignment of Executive Committee members.

h) BFIU may, from time to time, provide guidance to the Executive Committee (ICCAB) to implement global best practices in the industry and promote AML / CFT compliance culture.

i) IDRA may, from time to time, provide guidance/feedback to the Executive Committee (ICCAB) or BFIU so that there is perfect harmonization of AML / CFT regulation, rules, and circulars in the context of the Insurance Industry and current priorities. IDRA will support in setting the tone from the top in the insurance industry.

j) Global best practices and framework prescribed by FATF (Financial Action Task Force) must be promoted through its members (CAMLCOs)

Code of Conduct

Members must uphold the highest standards of integrity, confidentiality, and professionalism, and strive to strengthen AML and counter-terrorism financing controls within the insurance sector.

Amendments

Based on guidance from BFIU and IDRA, this Charter may be amended.

ICCAB EC Chair and General Secretary will, from time to time, review, amend, and approve the updated Charter.

All other EC Members will have the right to provide feedback, and based on an appropriate rationale, further amendments

may be agreed upon by ICCAB EC.